Table Of Content

- When does the seller get their money after closing?

- Who Pays Closing Costs?

- You’re our first priority.Every time.

- What is included in closing costs?

- Should You Refinance Your Mortgage in 2024? How to Know if it’s Worth It

- Title Fee

- Best Suburbs Surrounding San Francisco Bay Area of California

- C. Services You Can Shop For

Many fees and costs make up the final closing costs when buying a home. Ask your lender, title company, or your real estate agent to clarify if you have questions. It’s their job to help buyers and sellers finalize a property transfer. Just like you, they want the transaction to proceed smoothly – so you can move into your new home and begin enjoying your new space.

When does the seller get their money after closing?

Either way, expect to pay $75 – $200 or more for your title search. With a conventional loan, you also have the ability to pay for part or all of a PMI policy upfront at closing in order to have lower or no monthly fees for mortgage insurance. However, you might need to pay your transfer fee if you’re buying in a very competitive market. Your closing fee goes to the escrow company or attorney who conducts your closing meeting. In some states, an attorney must sign off on every mortgage closing.

Who Pays Closing Costs?

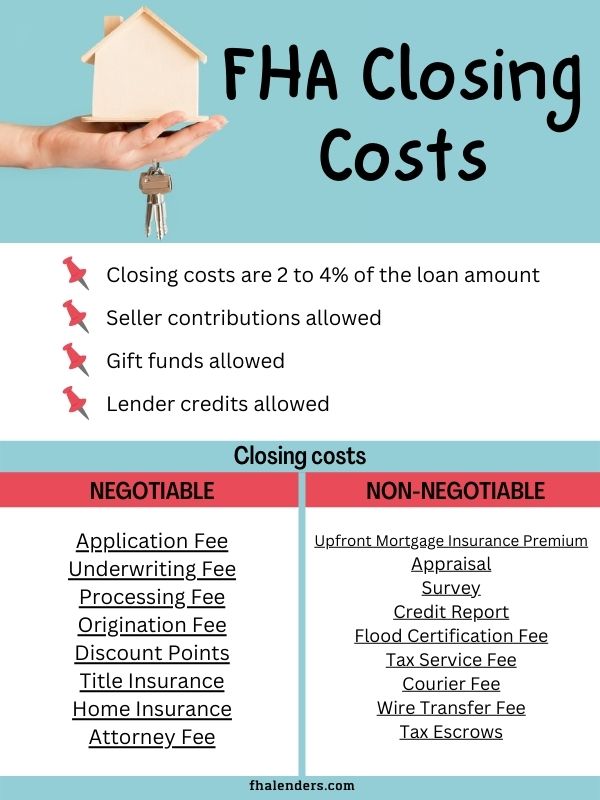

They can range from 2-5% of the mortgage amount for both home purchase and refinance loans. The specific closing costs you’ll pay depend on the type of loan you have, your home’s value and your state’s laws. Sellers may also need to pay for closing costs, depending on the sale agreement. Property taxes are fees you pay to your local government to subsidize public services. Property taxes fund key institutions such as public schools, roads and fire departments.

You’re our first priority.Every time.

RK Mortgage Group was considerate of my family's needs and provided options. They educated my wife and myself on the process and helped us make an informed decision . Ms. Meme excellent, very professional, patience of an angel. She kept us updated on everything that was happening with our loan.

Closing Costs In Massachusetts: Who Pays For What? - Bankrate.com

Closing Costs In Massachusetts: Who Pays For What?.

Posted: Mon, 23 Oct 2023 07:00:00 GMT [source]

In what seems to be becoming a daily occurrence, four more lenders have announced mortgage rate rises. For the housing market, one silver lining may come from buyers who have to acquire homes due to personal situations. Orphe Divounguy, a senior economist at Zillow Home Loans, echoed Hale's perspective on what will drive mortgage rates as inflation remains elevated. He previously worked as a reporter for the Omaha World-Herald, Newsday and the Florida Times-Union.

Contact a few competing loan providers and ask questions about the types of fees they charge. Choose a lender that offers low fees and competitive interest rates for lower overall closing costs. If you can’t afford closing costs, you may not be ready to buy a home. The buyer or the seller can pay closing costs in a real estate purchase transaction.

Title Fee

Shopping for a mortgage is about more than just an interest rate. This can prove challenging for home buyers on a tight budget. Dock David Treece is a former licensed investment advisor and member of the FINRA Small Firm Advisory Board.

The buyer pays most closing costs, but the seller pays some, such as the real estate agent’s commissions. As the buyer, you might try to negotiate some of your costs into the current homeowner’s corner, but that’s only feasible if the seller doesn’t have other offers on the table. With home sales, both buyers and sellers typically pay closing costs. The closing costs paid by sellers are typically deducted directly from the sale proceeds. No-closing-cost mortgages also have a higher interest rate that applies to the whole principal.

C. Services You Can Shop For

We’ve gone through some of the most common fees that make up your total closing costs. You can generally expect the total to be between 1 and 5% of the price you are paying to buy your home. Payment for closing costs can sometimes be financed with your loan, in which case it will be subject to interest charges. Alternatively, you can pay your closing costs in cash, similar to your down payment. The closing costs for a mortgage include all of the expenses related to applying for the loan and finalizing a real estate sale.

In May 2021, the average home in Southern California had a price tag of $752,250, which means a loan origination fee fell between $3,761 and $7,522. Another way for buyers to lower closing costs is to see if you’re eligible for government-sponsored assistance. There are often federal, state and even county-level programs available to help cover some or all of your closing costs, especially if you’re a first-time homebuyer. When looking at the state with the lowest buyer closing costs, Indiana is the cheapest at just $1,909, or 0.99% of the average home sales price. For the lowest closing costs as a percentage of the sales price, the cheapest states are Wyoming and Colorado, which are tied at 0.86%. Which party pays what fee may be negotiable, but the precise costs of many filing and recording fees or transfer taxes are determined by the state or local jurisdiction.

Amy also has extensive experience editing academic papers and articles by professional economists, including eight years as the production manager of an economics journal. We had an unusual condo purchase that most banks would not touch. Once we contacted RK Mortgage Group and spoke to Joelle her experience, knowledge and professionalism put us at ease. We were able to apply, submit all our required docs and close in less than six weeks. Until she was given the required documentation to help close the loan. Philadelphia home buyers may not be prepared for the expense of closing costs.

You can choose the one with the lowest closing costs outright, or you can take your best offer and ask another lender to match or beat it. Closing cost assistance is available from state housing finance agencies (HFAs) and some local governments, lenders, and nonprofits. This typically comes in the form of down payment assistance, which can be used to help pay for your down payment and/or closing costs. Rolling closing costs into the loan means you’ll pay interest on them, so they cost more in the long run.

You may have paid this upfront, or it may likely be a charge on the closing disclosure statement. Typically, closing costs run between 2% and 5% of the price of your home. On a home purchased for $300,000, closing costs could range from $6,000 to $15,000, which is a significant range. Or, you might accept a slightly higher interest rate if your lender will cover the closing costs and get your out-of-pocket expense to zero. Closing cost calculators can give you a general estimate if you want to know what yours will be. But to find your exact closing costs so you can budget appropriately for them, you’ll need to get an estimate from a lender.

All Loan Estimates use the same format, making it easy for you to compare rates and fees to find the best deal. Closing costs on a $100,000 mortgage might be $5,000 (5%), but on a $500,000 mortgage they’d likely be closer to $10,000 (2%). When someone buys real estate, a new deed showing their ownership must be filed with the local county recorder.

For conventional loans, insurance that protects the lender if you default on your loan. If your down payment is less than 20%, most lenders will require you to pay mortgage insurance. Prior to a sale, a title search is conducted to verify ownership.

There are two categories of charges you pay your lender to secure your mortgage. These fees are very common, although not all lenders charge them to all borrowers. Bank statement loan makes life a million times easier for self employed people. Entire process took about 30 days and I had access to my loan officers nearly 24/7. By far the smoothest mortgage process that we have ever had.

No comments:

Post a Comment